CISD will hold a public hearing on its Fiscal Year 2025-2026 proposed Budget and Tax Rates on Monday, Aug. 25 at 5:30 p.m. The hearing will take place at the Vonita White Administration Building located at 200 S. Denton Tap Road in Coppell.

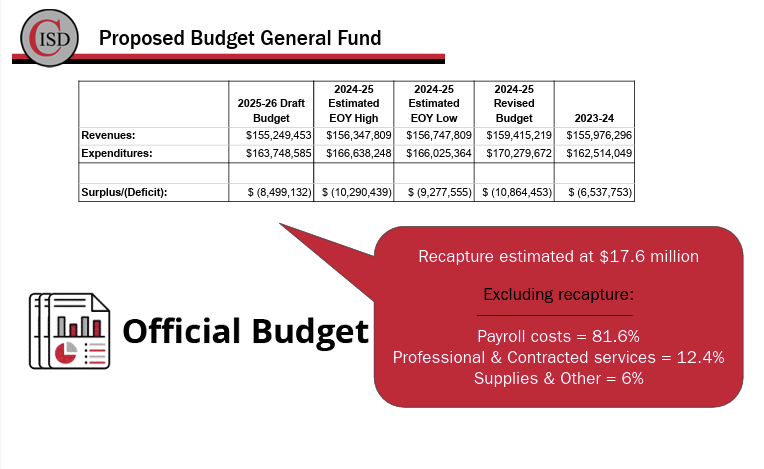

The proposed 2025-2026 General Fund Expenditure Budget is $163,748,585 with a Food Service Budget of $6,005,601 and the Debt Service Budget of $44,144,540.

The 2025-2026 proposed General Fund Budget has a deficit of $ 8,499,132. Recapture to the state is estimated at $17.6 million. Excluding recapture, the General Fund Budget breakdown is:

81.6% Payroll

12.4 % Professional and Contracted Services

6% Supplies and Other

The proposed Maintenance and Operations (M&O) tax rate is $0.7552, which is unchanged from the 2024-2025 school year, and the proposed Interest and Sinking (Debt Service) Tax Rate of $).2267, which is $0.0207 lower than last year.

CISD’s proposed overall tax rate for 2025-2026 will be a total of $0.9819 per $100 in assessed property value, which is a total tax rate decrease of $0.0207 per $100 in assessed value or a 2.06 percent decrease overall.

The tax rates have been set, as required by the state, assuming voter approval of increased exemptions during the November 4, 2025 general election. The ballot will include constitutional amendment propositions to increase the homestead exemption from $100,000 to $140,000 and to increase the exemption for those over 65 or disabled to $200,000.

A property owner’s taxes may rise even though the tax rate has been reduced, due to an increase in the value of the property, which is determined by the county appraisal district.

For more information about the budget or tax rate, visit the links below: